QuickBooks Opening Balance Equity Explained: A Simple Fix for Accurate Books

Have you ever noticed a mysterious balance under “Opening Balance Equity” on your QuickBooks Online (QBO) Balance Sheet? You’re not alone and the good news is, it’s an easy fix once you understand what it means.

What Is Opening Balance Equity in QuickBooks Online?

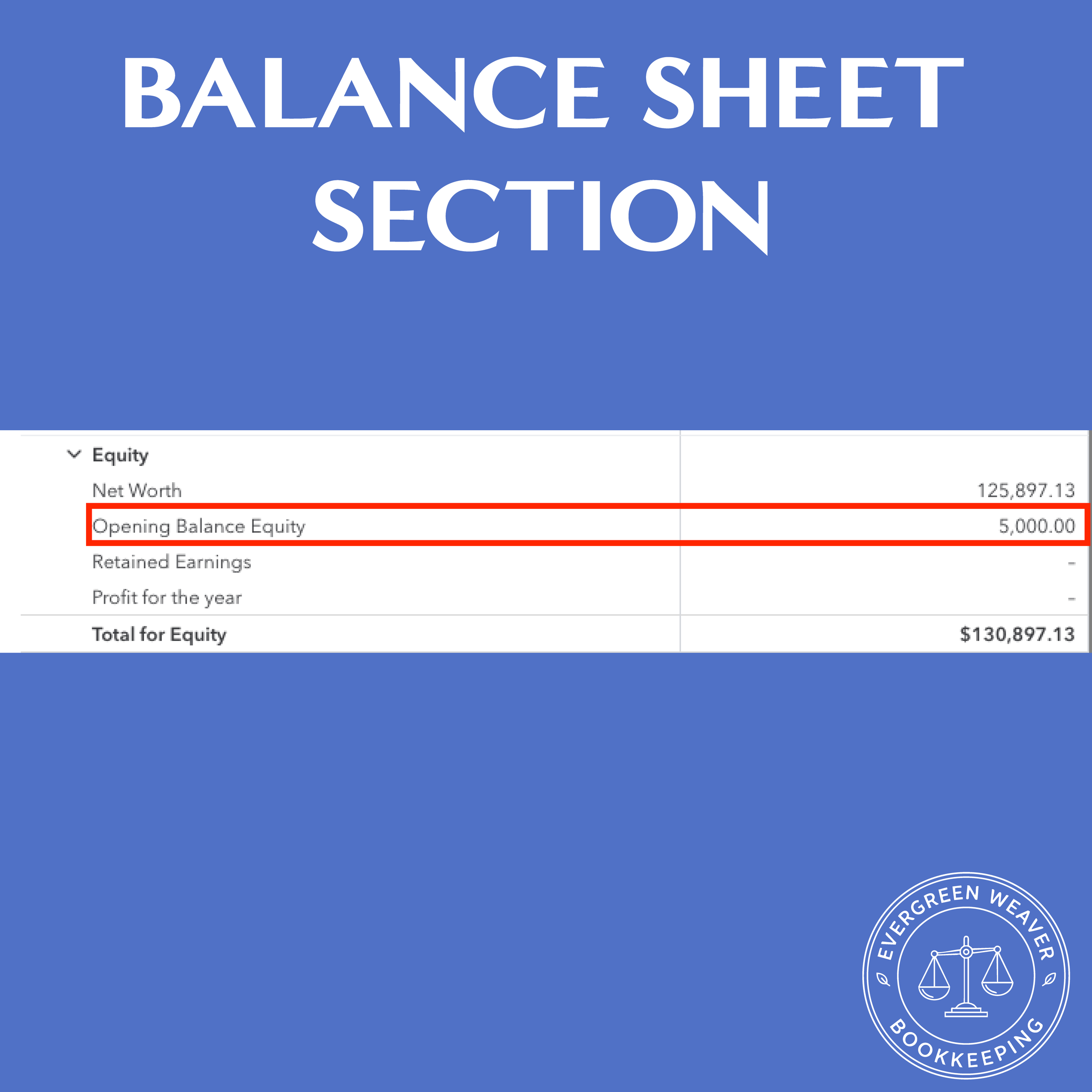

When you create a new asset or liability account in QBO and enter an opening balance, QuickBooks automatically posts that amount to an account called Opening Balance Equity. This account acts as a temporary placeholder so that your books stay balanced while you’re setting up your accounts.

Why Opening Balance Equity Should Always Be Zero

Opening Balance Equity should never hold a balance long-term. It’s meant to be cleared once you’ve correctly categorized all starting amounts. If it’s not zero, it often means:

An account was added with an opening balance but never adjusted.

Historical balances were entered incorrectly.

Old transactions weren’t assigned to the right equity account.

Leaving this amount untouched can make your Balance Sheet inaccurate, which may cause confusion at tax time or when you’re reviewing your business’s financial health.

How to Fix Opening Balance Equity

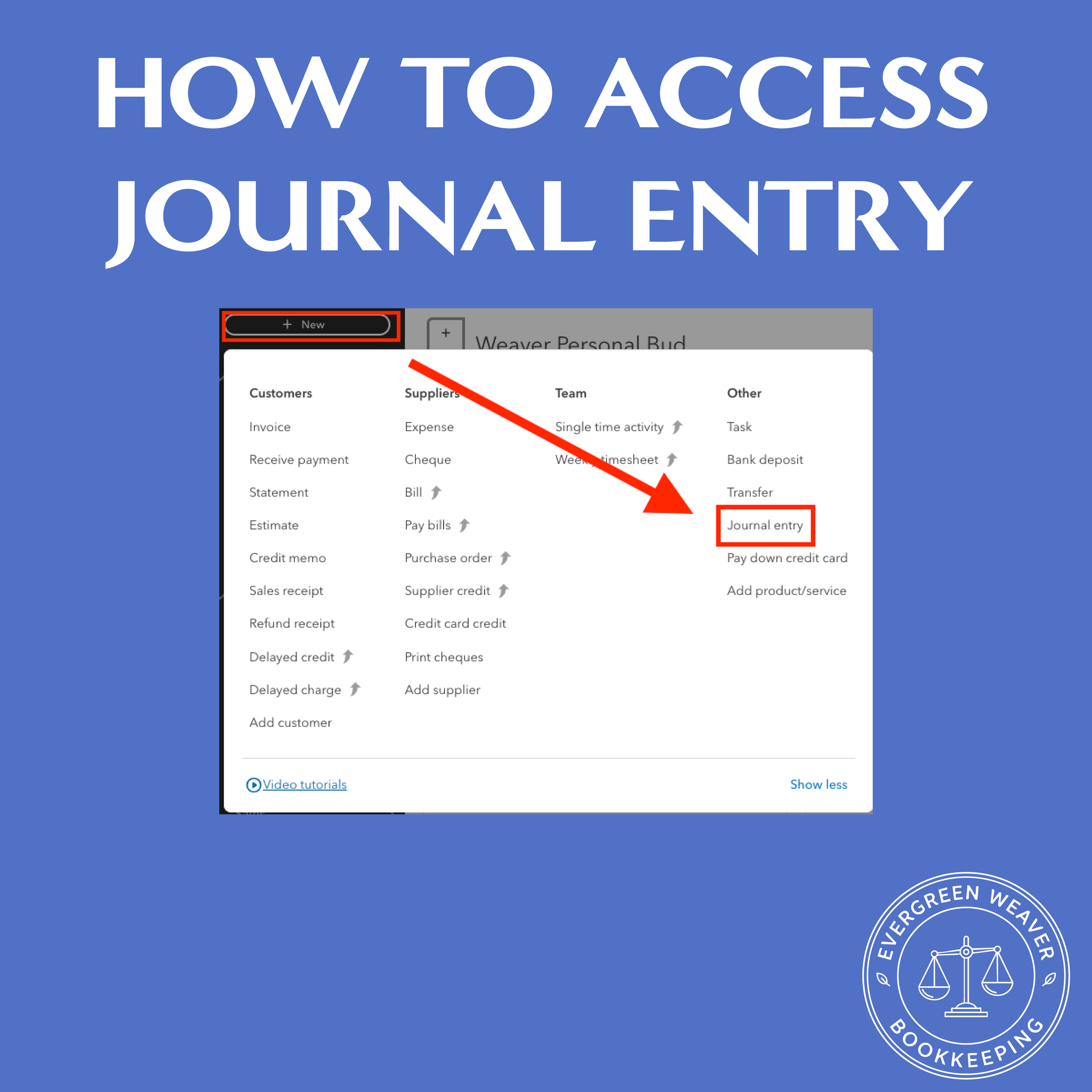

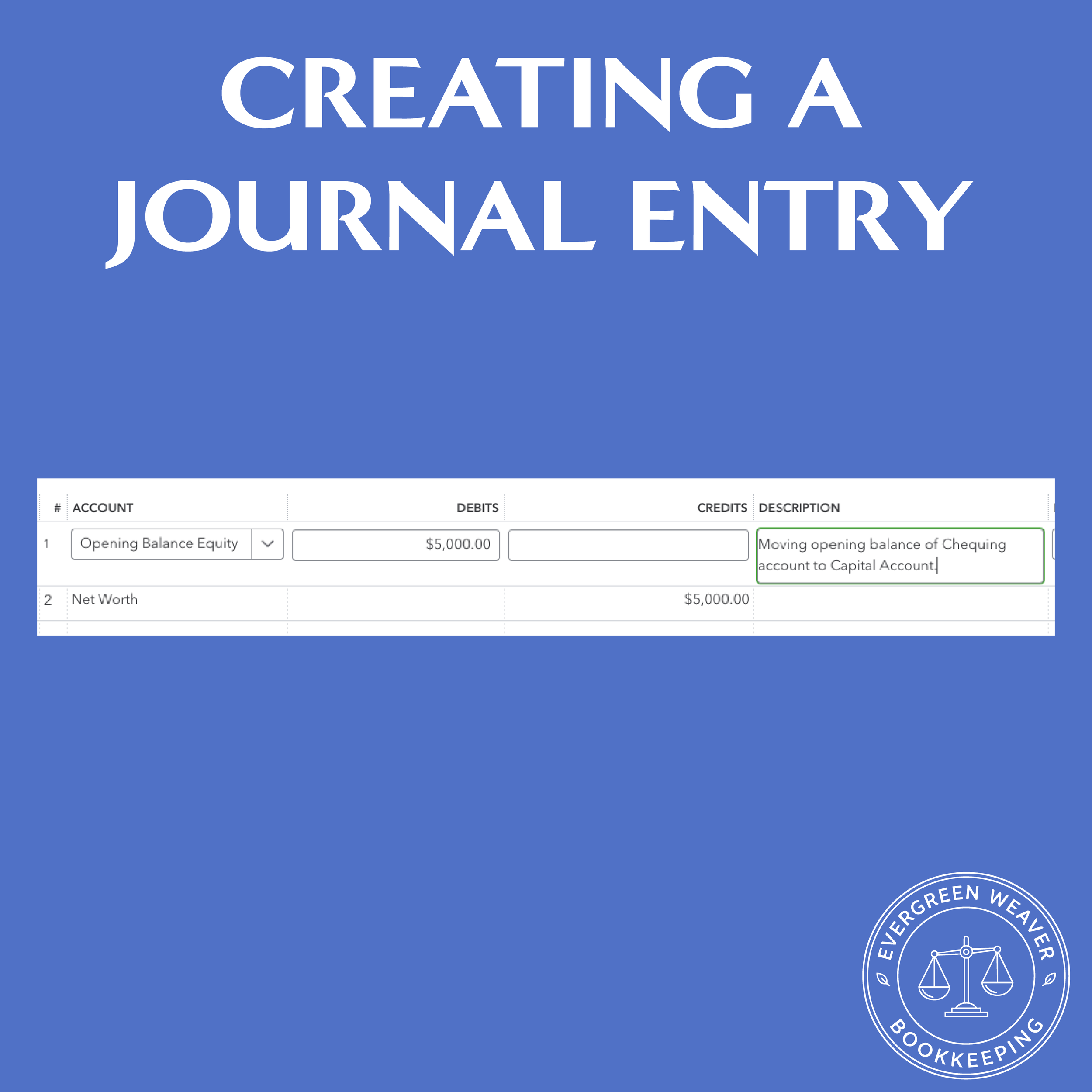

Once you’ve added all your new account, create a journal entry to transfer the balance from Opening Balance Equity to the proper permanent equity account.

Depending on your business structure, this may be:

Owner’s Equity (sole proprietors)

Partner Capital (partnerships)

Shareholder’s Equity (corporations)

Pro tip: Add a clear description to your journal entry (for example, “Adjusting Opening Balance Equity to Owner’s Equity”). You’ll thank yourself later when reviewing your records or preparing for year-end.

Why This Matters for Small Business Owners

Keeping your Opening Balance Equity at zero isn’t just about accounting accuracy, it’s about peace of mind.

When your books are clean and balanced:

You save time during tax season.

You avoid unnecessary stress when your accountant asks for reports.

You can focus on running and growing your business instead of troubleshooting numbers.

You have reliable insights into your business performance to make smarter financial decisions.

In other words, fixing this one small detail can make your bookkeeping easier and your financial picture clearer.

Still Seeing a Balance? Let’s Fix It Together

If your Opening Balance Equity account isn’t balancing or you’re not sure which equity account it belongs to, book a free 30-minute QuickBooks walkthrough (no obligation).

I’ll help you identify the cause, make the right adjustments, and get your Balance Sheet looking accurate and professional, so you can spend less time worrying about your books and more time building your business.